EB-5 FAQ

(Disclaimer: FAQ’s should be considered for use for informational purposes only and they are not intended as a replacement for qualified professional advice. Consultation with an immigration business attorney and/or qualified financial expert is strongly advised before choosing a New York EB-5 investment).

- How many immigrant visas are allotted for EB-5?

The EB-5 program allots 10,000 visas per year for aliens and family members whose qualifying investments result in the creation or preservation of at least ten (10) full-time jobs for U.S. workers. The new EB-5 Act of 2022 sets aside 32% of this annual EB-5 immigrant visa for specific types of EB-5 projects: 20% for rural area, 10% for high unemployment area as designated by USCIS; 2% for qualifying infrastructure projects administered by a federal, state or local government entity; unused reserves carry over to add to reserves for the next year, but in the third unused year go without reservations.

- Must an investor have previous business experience or a minimum level of education to participate in the EB-5 Program?

There are no requirements with respect to prior business experience or education. The only requirement is that the investor is accredited and meets certain suitability standards with respect to income, net worth, etc. The investor also must prove unconditionally that the source of funds is legal, through the submission of proper documentation.

- Must an investor speak English to participate in the EB-5 Program?

No, but it is strongly recommended that a non-English speaking investor should hire the services of a translator to ensure that the investor fully understands the investment terms and the offering materials are reviewed carefully before the investor makes a decision.

- What is a Limited Partnership?

A Limited Partnership is a business organization with one or more General Partners, who manage the business and assume legal debts and obligations, and one or more Limited Partners or Limited Investing members, who are liable only to the extent of their investments. Limited Partners also enjoy rights to the Partnership's cash flow, but are not liable for company obligations.

- How is the Limited Partnership interest protected?

The USCIS requires that some financial risk be assumed by the investor in order to qualify for the EB-5 Immigrant Investor Program. Each investor must qualify for the minimum at risk capital and new job creation requirement. Every effort is made by the General Partner to minimize the amount of risk by ensuring that the investment is properly collateralized and that the Partnership remains in strong financial standing.

- May several investors combine or "pool" their investment capital through one Limited Partnership?

The regulations specifically allow for the pooling of funds by several investors to establish a Limited Partnership sufficient to qualify all participating investors. The only requirement is that each investor must individually meet the minimum at risk capital and new job creation requirements.

- What are the risks associated with an EB-5 investment?

There are specific risk factors for each Limited Partnership, which are specifically addressed and described in detail in the offering materials for each Limited Partnership. Risk factors differ for each Partnership, but may include: economic conditions, failure to meet job requirements, and denied immigration status under the USCIS Immigrant Investor Program.

- How to become an accredited Investor?

In the U.S., an individual is considered to be an accredited investor if he or she has a net worth in excess of $1 million (excluding the value of the primary residence), or has income exceeding $200,000 each year for the last two years, $300,000 with spouse if married, and has reasonable expectation to earn the same amount in the current year and beyond.

For more information, please visit U.S. Securities and Exchange Commission webpage.

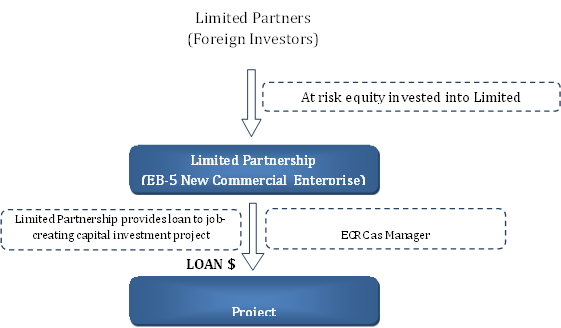

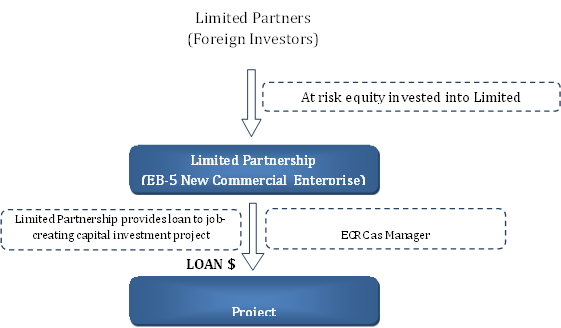

- Loan Based Investment Structure, how does it work?

Under the loan structure, capital invested into the limited partnership will be directed into one or several job-creating projects by means of a loan to a project developer. Loans will be made only to viable and creditworthy targets with sufficient assets or a third-party guaranty to provide a reasonable basis for the loan. The general partner and limited partners will not be equity owners of the project but of the limited partnership that provides the loan funding. See below flowchart:

Loan Based Investment Illustration Flowchart:

- What are the benefits of investing in the East Coast Regional Center?

All ECRC proposed projects have been professionally and thoroughly evaluated by ECRC professionals. Extensive due diligence is performed in order to minimize risk to the limited partners and to ensure a high degree of success possible for each project undertaken.

Investing in the East Coast Regional Center projects, here are the benefits the investors enjoy:

- Invest in one of the most dynamic markets in the world: health care and real estate industries in New York City and East Coast Region of the United States

- Reduced Minimum Investment Amount of $800,000: since all ECRC projects will be located in the TEA

- Loan Based Investment Structure – All ECRC investments will use the loan-based investment model including an identified party responsible for repaying the partnership and a defined exit strategy, via a specified loan maturity date. Unlike an equity investment, investors are not dependent upon “fair market value” to sell and receive a return of their investment.

- Relatively low-risks because of partnering with the highly qualified borrower development team and/or extensive collateral in private investments.

- Proven Approved Job Methodology –The critical element that determines EB-5 investor‘s success in obtaining the permanent EB-5 visa (green card) is the job creation element. It is important that the projects must be able to prove that ten new American qualifying jobs have been created by that EB-5 investor investment. ECRC works in team with the reputable economists, using only the proven approved job model, to verify the job creation forecast of each Borrower based on a detailed business plan specifying its employment needs. By pooling investments, ECRC is able to create a large overall investment fund that will be able go well above and beyond the required number of American jobs required by statute. Additionally, by law, ECRC as a federally designated EB-5 Regional Center benefits from being allowed to utilize both direct and indirect job creation to support the EB-5 investor’s requirement to create at least ten new American jobs.

- Clearly Defined Exit Plan of Action – The loan duration in ECRC partnerships is usually five years from the time the final investor funds are allocated. Once all partnership loans are repaid by the borrower, the liquidation process initiates as investors vote to liquidate the partnership. As nothing is required to be sold, the investment does not suffer from market fluctuation. ECRC investment partnerships enjoy a specified date for investment maturity.

- Financial transparency--financial records of the ECRC Partnership are available to our investors. All investors will be provided a secured log-in access to the partnership financials documents.

- Management fees that are capped and easy to calculate, which ensures that day-to-day management expenses will not dilute the return-on-investment or affect the investor’s principal.

- Will the ECRC assist clients in obtaining a Green Card?

Yes, though your own attorney will oversee and coordinate the application process, the ECRC team of professionals will answer questions and provide assistance through the process.

- How can I pursue a Green Card through the ECRC?

Please contact our office by calling us at (516) 759-2666 and speaking to a member of our staff.

We can also be reached by email at info@ECRCEB5.com. We eagerly await your call and are looking forward to speaking with you.

Phone:

Phone:  Email:

Email: